American Airlines Group Reports Second-Quarter 2018 Profit

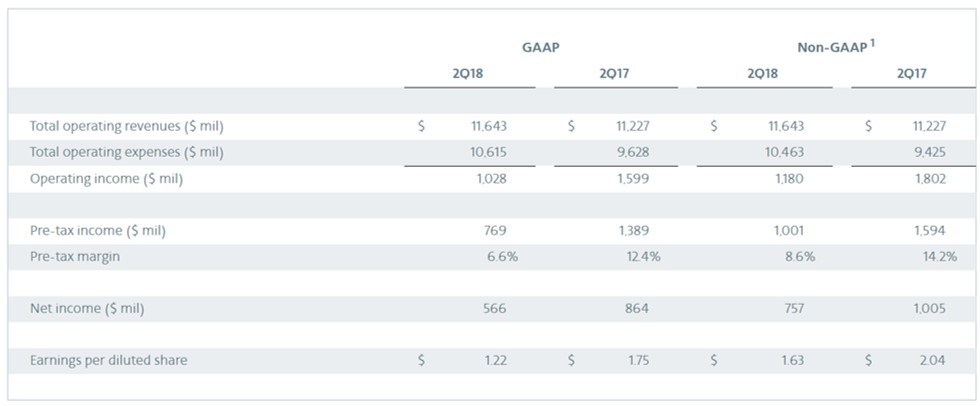

- Reported a second-quarter 2018 pre-tax profit of $769 million, or $1.0 billion excluding net special items1, and a second-quarter net profit of $566 million, or $757 million excluding net special items

- Second-quarter 2018 earnings were $1.22 per diluted share, or $1.63 per diluted share excluding net special items

- Returned $396 million to shareholders, including the repurchase of 8.2 million shares and dividend payments of $46 million

- Announced changes to Basic Economy so that beginning on September 5, it will include both a personal item and a carry-on bag like other Main Cabin fares

- Announced deferral of 22 Airbus A321neo deliveries from 2019, 2020 and 2021, lowering aircraft capital expenditures for those years

“This was perhaps the most challenging quarter for the American team since our merger with US Airways in 2013,” said American’s Chairman and CEO Doug Parker. “We had an operational disruption at our PSA Airlines subsidiary that was extremely trying for our customers and our team members; higher fuel prices increased our expenses by more than $700 million versus last year; and our revenues, while increasing, have begun to trail the rate of increase at our largest competitors for the first time since early 2016. Because fuel expenses are expected to increase by more than $2 billion this year, we expect 2018 earnings to be lower than last year.

“These near-term challenges do not dampen our long-term excitement about the future of American Airlines. We are taking aggressive action now to return American to prior profitability levels even at these much higher fuel prices. We are deferring aircraft deliveries and capital expenditures, lowering our 2018 capacity growth and reducing non fuel-related expenses. In addition, we anticipate that our 2019 capacity growth will be lower than our competitors and will be focused in our top-performing hubs at Dallas-Fort Worth and Charlotte. We are confident these actions will return American to both revenue outperformance and earnings growth in 2019 and beyond. As a result, we are very bullish on the future of American Airlines.”

Second-Quarter Revenue and Expenses

Pre-tax earnings excluding net special items for the second quarter of 2018 were $1.0 billion, a $593 million decrease from the second quarter of 2017, driven by higher fuel prices.

Continued strong demand for air travel drove a 3.7 percent year-over-year increase in second-quarter 2018 total revenue, to a record $11.6 billion. Passenger revenue per available seat mile (PRASM) grew in all geographic regions driven in part by a 6.2 percent increase in the Atlantic region. Cargo revenue was up 19.4 percent to $261 million due primarily to a 9.6 percent increase in volume and an 8.9 percent increase in cargo yield. Other revenue was up 8.1 percent to $708 million due to higher loyalty revenue. Second-quarter total revenue per available seat mile (TRASM) increased by 2.1 percent compared to the second quarter 2017 on a 1.6 percent increase in total available seat miles. This marks the seventh consecutive quarter of positive unit revenue growth and the third quarter in a row where all geographic regions showed PRASM growth on a year-over-year basis.

Despite record revenue, the improvement was outpaced by significantly higher year-over-year fuel prices. Total second-quarter 2018 operating expenses were $10.6 billion, up 10.3 percent year-over-year, driven by a 39.6 percent increase in consolidated fuel expense. Had fuel prices remained unchanged versus the second quarter of 2017, total second quarter 2018 expenses would have been $700 million lower. Total second-quarter 2018 cost per available seat mile (CASM) was 14.56 cents, up 8.5 percent from second-quarter 2017. Excluding fuel and special items, consolidated second-quarter CASM was 10.83 cents, up 2.4 percent year-over-year.

Basic Economy

To make Basic Economy more competitive, American is removing the carry-on bag restriction that is currently part of its domestic and short-haul international Basic Economy fare rules. This change will be effective September 5, for tickets purchased or flown that day. Until then, current Basic Economy fare rules will continue to apply, including the allowance for only one personal item.

“Basic Economy is working well in the markets where we offer it, and we continue to see more than 60 percent of customers buy up to Main Cabin when offered a choice,” said President Robert Isom. “Removing the bag restriction will make Basic Economy more competitive, allowing us to offer this low-fare product to more customers.”

Strategic Objectives

American Airlines is focused on four strategic objectives: Create a World-Class Customer Experience, Make Culture a Competitive Advantage, Ensure Long-Term Financial Strength, and Think Forward, Lead Forward. The company made progress on each of these long-term objectives during the second quarter.

Create a World-Class Customer Experience

American is committed to delivering a world-class customer experience by creating value and building trust with customers, driving operational excellence, and strengthening its network, especially where the company has a competitive advantage. During the second quarter, American:

- Was honored by the Freddie Awards for Best Elite Program in the Americas. This marks the seventh award in that category for American’s AAdvantage program. Introduced in 1988, the Freddies honor both airline and hotel loyalty programs and are based entirely on votes by travelers around the world

- Added 43 new routes, including seven new stations. This included new seasonal service between Philadelphia and Prague, Czech Republic (PRG), and Budapest, Hungary (BUD), between Chicago and Venice, Italy (VCE) and between Dallas-Fort Worth and Reykjavik-Keflavik, Iceland (KEF)

- Finished satellite Wi-Fi installation on the company’s widebody and international Boeing 757 fleet. American now has international Wi-Fi on all 150 widebody aircraft and 24 international Boeing 757s. Installation of high-speed satellite-based Wi-Fi continues on domestic mainline narrowbody aircraft, bringing the living room experience to more of the fleet

- Expanded Basic Economy throughout the trans-Atlantic network, giving customers a new option for the lowest fares on American and its Atlantic joint business partners

- Began accepting credit cards for on-board purchases on American Eagle flights. This is part of a larger effort to make the customer experience consistent across regional and mainline flights, including adding Wi-Fi and meal service on more regional aircraft

Make Culture a Competitive Advantage

American is creating an environment that cares for frontline team members, provides competitive pay, and equips its team with the right tools to support its customers. During the second quarter, American:

- Accrued $63 million for the 2018 profit sharing program, bringing the year-to-date total to $92 million

- Rolled out implicit bias training, with web-based instruction taking place now and in-person training ready by the end of the year. This is part of ongoing work that includes engaging an independent firm to assess American’s policies and procedures to ensure the company is working toward the inclusive environment customers and team members deserve

- Held “Elevate, One Connected Team” training sessions for almost 32,000 team members during the first half of the year. Also completed “Inspire like a Leader” training for 2,000 of the company’s managers, a two-day course that equips leaders with the tools to listen better and inspire and motivate their teams

- Awarded more than $3.4 million through recognition programs that reward team members for excellent customer service, operational performance and helping their coworkers

- Celebrated National Aviation Maintenance Technician Day on May 24 and Flight Attendant Appreciation Day on May 31

- Awarded more than $925,000 in 2018 scholarships to 345 children of team members through the American Airlines Education Foundation

Ensure Long-Term Financial Strength

American is focused on capturing the efficiencies created by the merger, delivering on its earnings potential, and creating value for its owners. In the second quarter, American:

- Returned $396 million to shareholders through share repurchases and dividends, bringing the total since mid-2014 to $12.3 billion. These repurchases have reduced the share count by 39 percent to 460.5 million shares as of June 30, 2018. As of that date, the company had $1.7 billion remaining of its current $2.0 billion share repurchase authorization2

- Completed a number of financial transactions, including paying off $500 million of unsecured notes and re-pricing and extending the company’s $1.8 billion South American credit facility

- Took delivery of one new Boeing 787-9 Dreamliner and four 737 MAX 8s

- On July 26, 2018, declared a dividend of $0.10 per share, to be paid on August 21, 2018, to stockholders of record as of August 7, 2018

Think Forward, Lead Forward

American is committed to re-establishing itself as an industry leader by creating an action-oriented culture that moves quickly to bring products to market, embraces technological change, and quickly seizes upon new opportunities for its network and product. In the second quarter, American:

- Completed the migration of the last of 20 applications that have been moved to the cloud over the past year, including portions of aa.com – one of American’s most mission-critical systems. Cloud technology allows for more rapid procurement of infrastructure as well as system development, which allows greater speed and flexibility in meeting business objectives. American’s Dynamic Rebooking system, which gives customers multiple alternative options in the event of a flight cancellation, continues rapid enhancement cycles as a result of its cloud technology foundation

- Ordered 15 new Bombardier CRJ900s and 15 new Embraer E175s. These comfortable 76-seat aircraft allow American to put the right aircraft in the right markets and deliver a customer experience that is consistent with the mainline

- Partnered with three leading flight schools and Discover Student Loans to create the American Airlines Cadet Academy. The Cadet Academy is designed to assist prospective pilots with a defined career path that eliminates the complexity and uncertainty traditionally associated with flight training certification by providing a path to an aviation career and financing to achieve it

Guidance and Investor Update

American recently reached an agreement with Airbus to defer delivery of 22 A321neos that were previously scheduled for delivery in 2019, 2020 and 2021 to extend deliveries and spread out the associated capital expenditures. These changes are expected to reduce planned capex by approximately $1.2 billion over the next three years. The company’s first A321neo is still scheduled for delivery in early 2019. Other changes to the fleet plan, including the impact of the company’s previously announced order of large regional jets, are detailed in the company’s investor update filed with the Securities Exchange Commission (SEC) this morning.

As American continues to optimize its network, the company is lowering its third-quarter capacity growth rate by approximately 0.6 percentage points and its fourth-quarter capacity growth by approximately 1.0 percentage point from its previous guidance. The company now expects its third-quarter capacity to be up approximately 3.3 percent, fourth-quarter capacity to be up approximately 1.6 percent, and full-year capacity to be up approximately 2.2 percent year-over-year.

Due to the success of the One Airline efficiency project that was outlined at its media and investor day, American is lowering its third- and fourth-quarter non-fuel cost outlook. The company now anticipates that its cost per available seat mile excluding fuel and special items (CASM-ex) will be up approximately 1.0 percent in the third quarter, and approximately flat in the fourth quarter. As a result, full year 2018 CASM-ex is expected to increase by approximately 1.5 percent year-over-year, which is 0.5 points lower than its previous guidance.

American expects its third-quarter 2018 TRASM to increase approximately 1.0 to 3.0 percent year-over-year. The company also expects its third-quarter 2018 pre-tax margin excluding special items to be between 5.0 and 7.0 percent.3 Based on today’s guidance, American now expects its 2018 diluted earnings per share excluding net special items to be between $4.50 and $5.00.3

For additional financial forecasting detail, please refer to the company’s investor update, filed with this release with the SEC on Form 8-K. This filing will be available at aa.com/investorrelations.

Notes

- In the second quarter, the company recognized $232 million in net special items before the effect of income taxes. Second quarter special items principally included $83 million of fleet restructuring expenses, $60 million of merger integration expenses, a $26 million non-cash charge to write-off the company’s Brazil route authority intangible asset as a result of ratification of the U.S.-Brazil Open Skies agreement, offset in part by a $57 million net credit resulting from mark-to-market adjustments on bankruptcy obligations. The company also recognized nonoperating special items totaling $80 million. These special items principally consisted of $66 million of mark-to-market unrealized losses primarily on the company’s equity investment in China Southern Airlines, and $14 million of costs associated with debt refinancings and extinguishments. See the accompanying notes in the Financial Tables section of this press release for further explanation, including a reconciliation of all GAAP to non-GAAP financial information.

- Share repurchases under the buyback program may be made through a variety of methods, which may include open market purchases, privately negotiated transactions, block trades or accelerated share repurchase transactions. Any such repurchases will be made from time to time subject to market and economic conditions, applicable legal requirements and other relevant factors. The program does not obligate the company to repurchase any specific number of shares or continue a dividend for any fixed period, and may be suspended at any time at the company's discretion.

- American is unable to reconcile certain forward-looking projections to GAAP as the nature or amount of special items cannot be determined at this time.